You’ve decided you are ready to take on the challenge of the CFA® exam and become a Chartered Financial Analyst® (CFA®). Make sure you have thought this through because it’s going to be a tough couple years. Even though only 20% of the people who take Level I make it all the way to the end and earn their CFA® license, there is no secret to passing the exam.

CFA® Level 1 Questions 2021: The Chartered Financial Analyst® Institute has reduced the number of CFA® Level 1 Questions in the new CBT format introduced from 2021. The computer-based exam will have 180 questions in the CFA® level 1 exam. There will be no negative marking awarded for any question and each exam will be given equal weight. CFA Level 1 v1.0 (CFA Level 1) Question 1 Mirabelle is an experienced analyst who has worked for the investment research arm of Clifford & Clifford, Inc. For the past 7 years. Recently, TransOmega retained Clifford & Clifford to conduct a study on possible takeover candidates in the aviation industry. CFA exam level I consists of 180 multiple choice questions. Students will take the exam in two sessions with the opportunity to take a break between sessions. Students will be tested in the following categories for CFA level I: Students will take section one of the CFA level I exam first.

You will need an organized and disciplined approach to conquer this beast. I’m here to help you through it, starting with Level I. Trust me, you don’t want to just dive in, as you want to have an idea of your overall studying strategy.

You have about 300 hours of studying ahead of your for Level I, so I suggest starting 5 to 6 months before your exam date. There is a lot of material—an understatement if there ever was one—so it is important to pace yourself. This will help prevent you from burning out before exam day arrives. I also strongly recommend you use a CFA® test prep course to aid your self-studies, in addition to the CFA® Institute syllabus.

Cfa Level 1 Questions

The material for Level I is generally not difficult to understand for any business-savvy person, but the amount is substantial—you’re going to see a lot of your basic econ 101 material, but also a ton of higher level concepts weaved into this mix. Some test prep guides will suggest 250, but the average amount of time spent studying for passing candidates is around 313 hours. Don’t underestimate the time and effort it takes to pass this exam. If you’ve already put in 280 hours of work, what’s another 20 or 30 in the grand scheme of things?!

A crucial step in passing the CFA® is setting a strict study schedule for yourself to tackle the mountains of material ahead of you. If you can stick to your schedule and really avoid skipping any planned sessions, then you have the self discipline to pass Level I and ultimately the entire CFA® exam. I thought about it like I was the kid who had to watch the other children play while I was inside doing homework—it wasn’t fun, but I knew there was a reason behind it all.

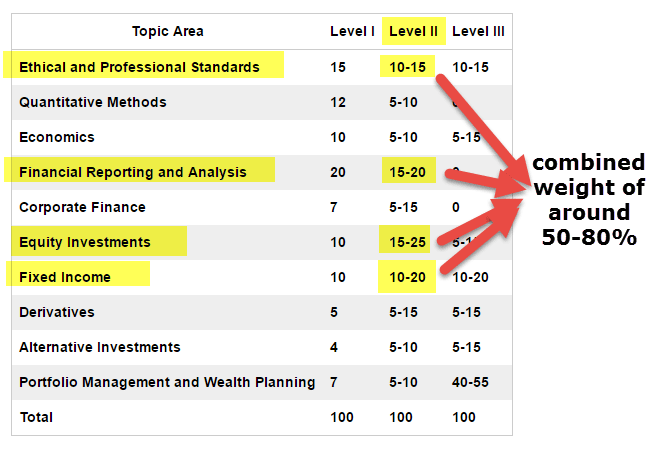

After reading the curriculum, a big mistake you could make is to ignore the Ethics portion. This is a bad call since the Ethics material will extended to all three levels of the CFA® exam. You should be able to understand Ethics for Level I so when you move forward to the other levels you will have a strong base set in place.

It’s rumored that you cannot pass the exam without passing Ethics. This is technically not true because you can skip Ethics if you crush everything else, although that’s extremely rare. BUT, your score in Ethics will decide whether you pass or fail if you are close to the minimum passing score. The “ethics adjustment” will determine whether you crash or burn. It’s always a good idea to seek out additional CFA® test prep materials if the CFA® Institute curriculum is too dry for you.

The most important part of your study schedule is the practice exams. Many will plan to study the material up to right before the exam day, but largely ignore the practice tests. This is a huge mistake and leads to a below-passing score. You should give yourself plenty of time (some say around a month) before the exam to take as many practice exams you can. A good rule of thumb is to shoot for 6 practice exams before test day.

The purpose of practice tests is to let you know if your hours of studying have paid off. Practice tests pinpoint your strengths and weaknesses, telling you which areas need more work and what topics you have mastered. They will also help you gauge the time it takes you to complete the exam, which is a concern for Level I. Utilize the practice exams in your test prep course, and you will significantly improve your chances of success.

There are 240 questions in Level I and a limited amount of time. Level I is the most time restricted in terms of the volume of questions that need to be answered, so the risk of not finishing is always there. If this happens to you on test day, it is better to guess blindly for the rest of test than nothing at all. There is no penalty for guessing.

The Minimum Passing Score (MPS) set by the CFA® Institute will never be higher than 70%. This means that the highest score bracket for passing a specific topic is 70%-100%, but you do not need to reach that in every topic to pass, as long as you can make up for losses in another topic.

Free Cfa Level 1 Questions

You should aim for 70% or higher in your practice exams so on test day you will be confident that you are at least close to passing on the topics with which you are struggling and exceed that level in your stronger areas. Remember, 70% in the actual exam equals success, but below 70% does not always mean failure.

Sample Cfa Level 1 Questions

After months and months of studying, you might forget to give yourself time to prepare for the exam. You will need to sort out the logistics of exam day to avoid running into any surprises that can fluster you on test day. Read up on what to bring on exam day and you may want to check out where the test center will be beforehand. Don’t put your efforts in vain by forgetting your passport or some other logistical error. These details should be the least of your worries before taking the CFA® Level I exam. Best of luck!